To stay competitive with the industry average for specialty retail of 15 collection days, the accounts receivable balance should be approximately $6,000 with average sales of $395 a day. $395 x Average Collection Period Days = Accounts Receivable Balance. Then Average Sales Per Day x Average Collection Period = Accounts Receivable Balance. If the Average Collection Period = Accounts Receivable Balance/Average Sales per day, Simply use the average collection period above to calculate what the accounts receivable balance should be to stay within a given collection period (e.g.

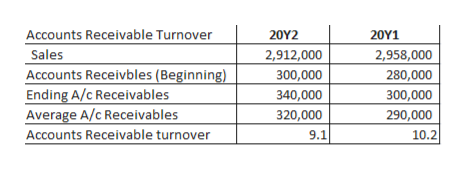

In fact, we can check what the balance of accounts receivable should be throughout the year to stay competitive with industry standards. If Sunny Sunglasses has an Achilles Heel in its profitable operations, it may be the low accounts receivable turnover. Sunny’s accounts receivable account balance should not be increasing very much over the course of the year if the company is to remain within industry standards. It also has a low accounts receivable turnover ratio compared to its main competitor and especially the industry average. Sunny Sunglasses has an average collection period of 54 days after one year of operations. The next step is to add meaning to these numbers by comparing them with the industry averages: Financial Statement Analysis Industry Ratios: Accounts Receivable Turnover Company When comparing turnover ratios, make sure that the same sales type is used when calculating receivable turnovers (credit sales or total sales). Since many companies do not disclose total sales on credit, users of financial statements may use this method to determine accounts receivable turnover using total sales. The average collection period uses the last known accounts receivable balance for the period.Īverage Collection Period and Accounts Receivable Turnover The average collection period can be translated to accounts receivable turnover by dividing the number of days a year by the average collection period, or 365/54 = 6.8. Average Collection Period = 21,200/395 = 54 Days Average Collection Period = Accounts Receivable/Average Sales Per DayĪverage Collection Period Example 1. Average Sales Per Day = Credit Sales or Total Sales/365Ģ. Where Average Receivables = (0 + 21,200)/2 = 10,600Īlternatively, businesses may calculate accounts receivable turnover in a two – step process as follows:Ĭalculating the Average Collection Period 1. Plugging the numbers into the formula, we get 6.6. Sunny knows that his net credit sales for the year were $70,000. Since Sunny Sunglasses Shop started business in January of 2010, there is no beginning accounts receivable balance. Net receivables at year-end equal $21,200.

Where net average receivables = (beginning net receivables balance + ending net receivables Balance)/2 Accounts Receivable Turnover Calculation: Net Credit Sales/Average Net Receivables, Estimates are usually based on historical uncollectibles. It is also a business risk that a certain percentage of customers will not pay balances due at all, so measures of uncollectible accounts should be made when it can be reasonably estimated. For example, the company could use the cash to invest the money and earn interest, pay down debt from which the company is incurring interest expenses, or finance growth opportunities instead of having money tied up in accounts receivable.

#Industry standard accounts receivable turnover free#

An extension of credit is then essentially an interest free loan to customers, and not collecting payments on time creates inefficiency and opportunity costs for the company. Most companies do not charge interest on accounts receivable unless the account becomes past due.

A low turnover indicates collection problems and possible bad debts. Financial Statement Analysis and Accounts Receivable Turnover Accounts receivable turnover allows a company to measure whether or not the company is effectively collecting payments on its accounts receivable, or its sales on credit.Ī high turnover indicates higher cash basis sales or efficient collections.

0 kommentar(er)

0 kommentar(er)